Payment apps now seem as ubiquitous as cash was (Average Reach of payment wallets is ~60% in top cities), thanks to the impetus of Demonetization and then COVID, pushing people towards contactless payments. Be it Institutions, merchants or handymen…anyone selling anything is on one or more payment platforms. Are people who [still] use paper money Kaagaz Ke Fool!? :D

Today’s teardown examines how the PayTM, Flipkart backed (now Walmart backed) PhonePe, Google Pay and Amazon Pay square off.

Surprisingly (for me atleast), Google Pay is the most dominant app in terms of Reach or penetration amongst internet users. PhonePe is a close(ish) second but distinctly ahead on engagement (measured both via open rates and weekly usage). This could have to do with its innovative user acquisition initiatives like Switch and Switch Gully. (Read More)

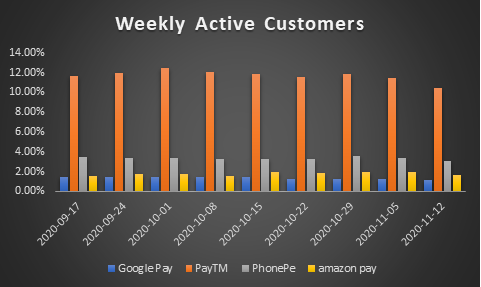

Weekly Active Customers are people who actually transact on a platform unlike “Weekly Active Users” who simply access a platform, but don’t transact. Its only when you look at the volume of people who actually transact do you realize how far ahead PayTM is of the competition.

Though PayTM’s engagement rates maybe lower, the number of users actually transacting on it are exponentially higher.

PayTM’s Average Order Frequency, much like its WAC, trends much higher than other wallets.

Average Order Values are similar across apps till Amazon’s Great Indian Festival 2020 kicks in, giving a sharp boost to Amazon Pay — just one more part of their “holistic” user engagement strategy.

Age is just a number?

As you may have expected, the penetration of payment platforms reduces with Age.

WAC or weekly Active Customers shows the same kind of declining trend seen with Reach. This isn’t the case with Amazon Pay, where transactions are consistent across age groups — possibly because amazon pay sits on top of amazon’s e-commerce platform rather than a stand-alone app.

Interestingly, this is a space we should expect to heat up further. WhatsApp Pay is likely to scale up usage and given its deep penetration amongst Indian internet users — they may well be the late entrant to take the trophy — now that everyone else has taken care of customer education for them!

For Data and Insights that could help your make better decisions; Get in touch!

Thanks for your time,

- Aman

aman@kalagato.co